Investments

The Outlook for smaller Companies

Ruairi McDonald, Investment Development Manager, discusses the market outlook for the Smaller Companies asset class.

id

Smaller Companies as an asset class closed out 2024 on a much brighter note than the previous year.

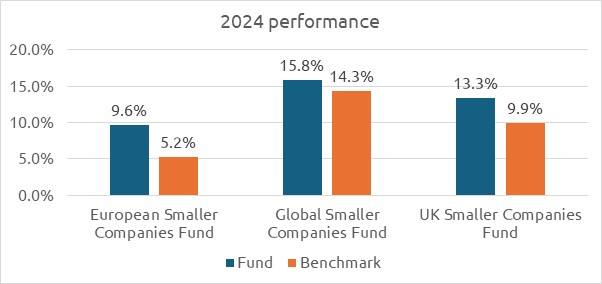

Our Global, European and UK Smaller Companies funds all outperformed their benchmarks by 1.5%, 4.4% and 3.4% respectively, gross of AMC.

Source: FE fundinfo, 22 April 2025. Performance is gross of Annual Management Charge, taxes and adviser charges.

Past performance is not a reliable guide to future performance. If you invest in these funds you may lose some or all of the money you invest. Benefits may be affected by changes in currency exchange rates.

id

More recently, President Trump’s tariff war has certainly darkened the mood across financial markets. Markets don’t like uncertainty, and Trump’s yo-yoing on his application of tariffs globally has caused significant market uncertainty and with it an abundance of volatility.

At the time of writing European equities have eked out a 1% gain year-to-date, 10% off its 3 March closing high. Global equities are down 12.7%, with US markets taking the brunt of losses this year. The S&P500 and Nasdaq are down 15.8% and 17.9% respectively. Smaller companies as an asset class have been hit harder, as they tend to be during periods of heightened volatility.

As US trade policy remains fluid, volatility will continue to be elevated. The policy has obvious implications for US inflation, and as such monetary policy, and for global growth more widely. Whilst it is difficult to predict the exact outcome of these changes, uncertainty itself often has a negative impact on consumer and business activity and could lead to an earnings slowdown. As such, markets, particularly those with a high degree of ownership concentration, may be vulnerable to further correction.

The Global Smaller Companies Fund has been underweight to the US prior to the tariff announcements. Even prior to the US election, management teams were flagging a more challenging economic outlook leading to cautious company earnings guidance. It is worth pointing out that economic growth in the US was starting to plateau before President Trump announced his tariff changes.

In contrast to the US, several European countries are beginning to emerge from a recession, in part, helped by larger interest rate cuts, which have taken longer to take effect. Moreover, Germany’s fiscal stimulus has provided a much-needed boost to the region.

Aside from geographic positioning, it is critical for investors to focus on ‘quality’ companies. In other words, companies that have the financial strength and adaptability to flex their supply chain, a deep understanding of the needs of their customers and the market share clout to maintain pricing power.

An important point to note is that the small-cap asset class may hold up better than large caps. Small caps tend to be more domestically focused and therefore less exposed to tariff uncertainty.

Small caps don’t always outperform

For example, recent years have been challenging. Let’s look at European small cap as an example. The chart below shows the returns of our European Smaller Companies Fund, net of AMC, and its benchmark versus European large-cap equities.

Source: FE fundinfo, 17 April 2025. Fund performance is net of AMC, gross of adviser charges and taxes.

You cannot invest directly in an index. Past performance is not a reliable guide to future performance. If you invest in this fund you may lose some or all of the money you invest. Benefits may be affected by changes in currency exchange rates.

Recent years have not been the norm. Small cap underperformance was due to several factors: the rapid rise in inflation and subsequent dramatic climb in interest rates, the war in Ukraine, supply-chain disruptions, and several additional macroeconomic concerns. But there’s another factor at play: index composition.

Over the last three years, a few heavyweight names have driven the large-cap index, with Novo Nordisk, Shell, Novartis, SAP, and HSBC all up over 50%. By contrast, the sheer weight and diversity of smaller companies mean it’s impossible for a handful of names – no matter how well they perform – to drive the entire index.

Consider long-term performance

While the last few years have been challenging, the chart below shows the benefits of staying the course. I’ll use the European Smaller Companies Fund, net of AMC, as an example again. The fund has delivered superior returns, net of AMC, versus its benchmark and versus large cap European equities since launch.

A €100,000 investment into the Standard Life European Smaller Companies Fund:

Source: FE fundinfo, 17 April 2025. Fund performance is net of AMC, gross of adviser charges and taxes.

You cannot invest directly in an index. Past performance is not a reliable guide to future performance. If you invest in this fund you may lose some or all of the money you invest. Benefits may be affected by changes in currency exchange rates.

Final thoughts

Corporate balance sheets are flush with cash, often triggering merger and acquisition activity, with smaller companies historically benefiting. Higher-quality companies continue to be cheap relative to lower-quality companies, which is a core investment tenant of the actively managed smaller companies funds. Smaller companies as an asset class are historically attractive, while growth as an investment style, also looks inexpensive. Cool heads and iron stomachs will no doubt be needed over the next couple of months with volatility in markets likely to persist.

id

Standard Life are delighted to announce a reduction in the annual management charges (AMC) for our Global and European Smaller Companies Funds.

We have reduced the AMC of both funds to 1.30%. This means our entire actively managed, Smaller Companies range of funds is now priced at 1.30%, which means that, depending on the allocation rate you give your client and commission that you take, these funds can be accessed from as low as 0.80%. We firmly believe that these reductions to the funds’ AMCs, will further support superior long-term investment returns for your clients that are invested, or intend to invest, in these funds.

Our Vanguard Global Small-Cap Index Fund is priced at 1.05% and can be accessed from as little as 0.55%.

A version of this article is available to read in the May 2025 edition of Irish Broker Magazine.